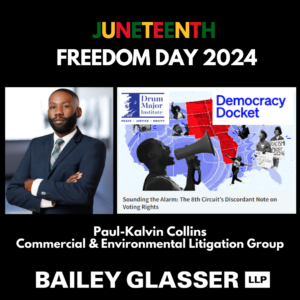

Join Bailey & Glasser, LLP in celebrating Juneteenth Freedom Day 2024.

Join Bailey & Glasser, LLP in celebrating Juneteenth Freedom Day 2024.

While the Emancipation Proclamation of 1863 officially freed enslaved persons in the South, the proclamation could not realistically be enforced in any location where the Confederacy remained in control, including the westernmost state of Texas. It was not until Union soldiers led by Major General Gordon Grange arrived in Galveston on June 19, 1865 – more than two months after the Confederate Army surrendered – that the state’s enslaved residents finally learned slavery had been abolished.

For Black Americans, gaining the full rights of citizenship—and especially the right to vote—was central to securing true freedom and self-determination. “Slavery is not abolished until the Black man has the ballot,” Frederick Douglass famously said in May 1865. While the 15th Amendment passed in 1869 gave Black men the right to vote, they were still largely kept from voting due to literacy tests, poll taxes, and campaigns of violence designed to marginalize the Black vote across the South and thereby silence their voices in the political realm.

In 1965, President Lyndon B. Johnson signed the Voting Rights Act into law, designed to remove barriers to political participation by racial and ethnic minorities, with Sections 2 and 5 being two provisions that brought new protections to voters across the country. Litigation over the scope and coverage under the Voting Rights Act hasn’t ceased since its passage, reflecting the ongoing strife and struggle over the fundamental ability to vote – a founding principle of this country.

In a Democracy Docket article, “Sounding the Alarm: The 8th Circuit’s Discordant Note on Voting Rights,” Martin Luther King III, leader of the organization Drum Major Institute, and Bailey Glasser lawyer Paul-Kalvin Collins draw attention to the 2023 ruling by the United States Eighth Circuit Court of Appeals that bar private litigants from bringing lawsuits under Section 2 of the Voting Rights Act, “the very bulwark against racial discrimination in voting.”

Earlier this year, the Eighth Circuit denied an appeal to review a previous three panel ruling finding that federal law does not allow private groups and individuals — who have for decades brought the majority of lawsuits under Section 2 of the Voting Rights Act — to sue because that law does not explicitly name them. Only the head of the Justice Department, the panel found, can bring these kinds of lawsuits. This decision is the first of its kind, with other federal courts weighing in on this issue, including the U.S. Supreme Court, opposing this decision or favoriting private plaintiffs in Section 2 cases.

The article warns of the ruling’s impact on the safeguards of voting rights and the “potential reverberations through the foundations of our democracy.” To read the full article visit here.

The nonprofit Drum Major Institute, first founded by Rev. Dr. Martin Luther King Jr. in 1961, continues his fight for justice and equality. “Together, as drum majors for justice, we can ensure that the dream of Dr. King endures, and the Voting Rights Act remains a potent instrument in the pursuit of a more equitable and inclusive America.” Learn more about DMI here.

For more information on lawyer Paul-Kalvin Collins, visit here.

#Juneteenth #FreedomDay #Diversity

Congratulations to BG lawyer Bryce Tish on the publication of his note in the Drake University Law Review, titled “Such Good Boys: The Dogmatic Casting Alert and Probable Cause for Drug Sniffing Dogs.” Bryce is a member of the firm’s Consumer Protection Practice Group, and is in our Iowa office.

Congratulations to BG lawyer Bryce Tish on the publication of his note in the Drake University Law Review, titled “Such Good Boys: The Dogmatic Casting Alert and Probable Cause for Drug Sniffing Dogs.” Bryce is a member of the firm’s Consumer Protection Practice Group, and is in our Iowa office.