BG secured approval for a $3.65 million settlement in a class action before a Pennsylvania federal district court on behalf of federal student loan borrowers charged illegal fees just for paying their monthly loan payments online or over the phone.

BG secured approval for a $3.65 million settlement in a class action before a Pennsylvania federal district court on behalf of federal student loan borrowers charged illegal fees just for paying their monthly loan payments online or over the phone.

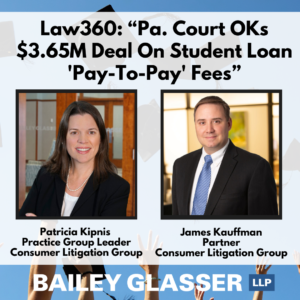

The lawsuit against Educational Computer Systems Inc., alleges that the servicer charged federal student loan borrowers nationwide illegal “Pay-to-Pay” fees, or extra charges to process one–time monthly payments on their Perkins loans online or by phone, in violation of several federal and state consumer protection laws. Bailey Glasser’s Patricia Kipnis, partner and leader of the firm’s Consumer Litigation Practice Group, and partner James Kauffman, along with attorneys from the law firm Tycko & Zavareei LLP, are class counsel in this case.

On Monday, U.S. District Court Judge Patricia A. Dodge stated on the record that she would grant the motion for final approval of the settlement and the motion for attorney fees, administrative costs, and class representative awards, with a formal order to follow. The motion for settlement included the $3.65 million payment that will refund more than 40,000 class members a pro-rata portion of the fees they paid to ECSI.

Judge Dodge remarked on the record describing the settlement as “fair and equitable,” and stated, “this case was administered effectively, litigated appropriately, and very well.”

Lead counsel Patricia Kipnis said, “We’re thrilled with this result in what we believe to be the first case against a student loan servicer asserting the legal theory that Pay-to-Pay fees are unlawful under consumer protection statutes.”

You can learn more about this settlement by reading this Law360 article here.

And for more information on our Pay-to-Pay services, visit here.

#baileyglasser #classactions #paytopay #consumerprotection #illegalfees #studentloans

Bailey & Glasser, LLP secured a groundbreaking $3.6 million settlement in a class action before a federal district court in Washington, D.C on behalf of consumers who were charged illegal fees just for paying their mortgages over the phone. BG partner

Bailey & Glasser, LLP secured a groundbreaking $3.6 million settlement in a class action before a federal district court in Washington, D.C on behalf of consumers who were charged illegal fees just for paying their mortgages over the phone. BG partner