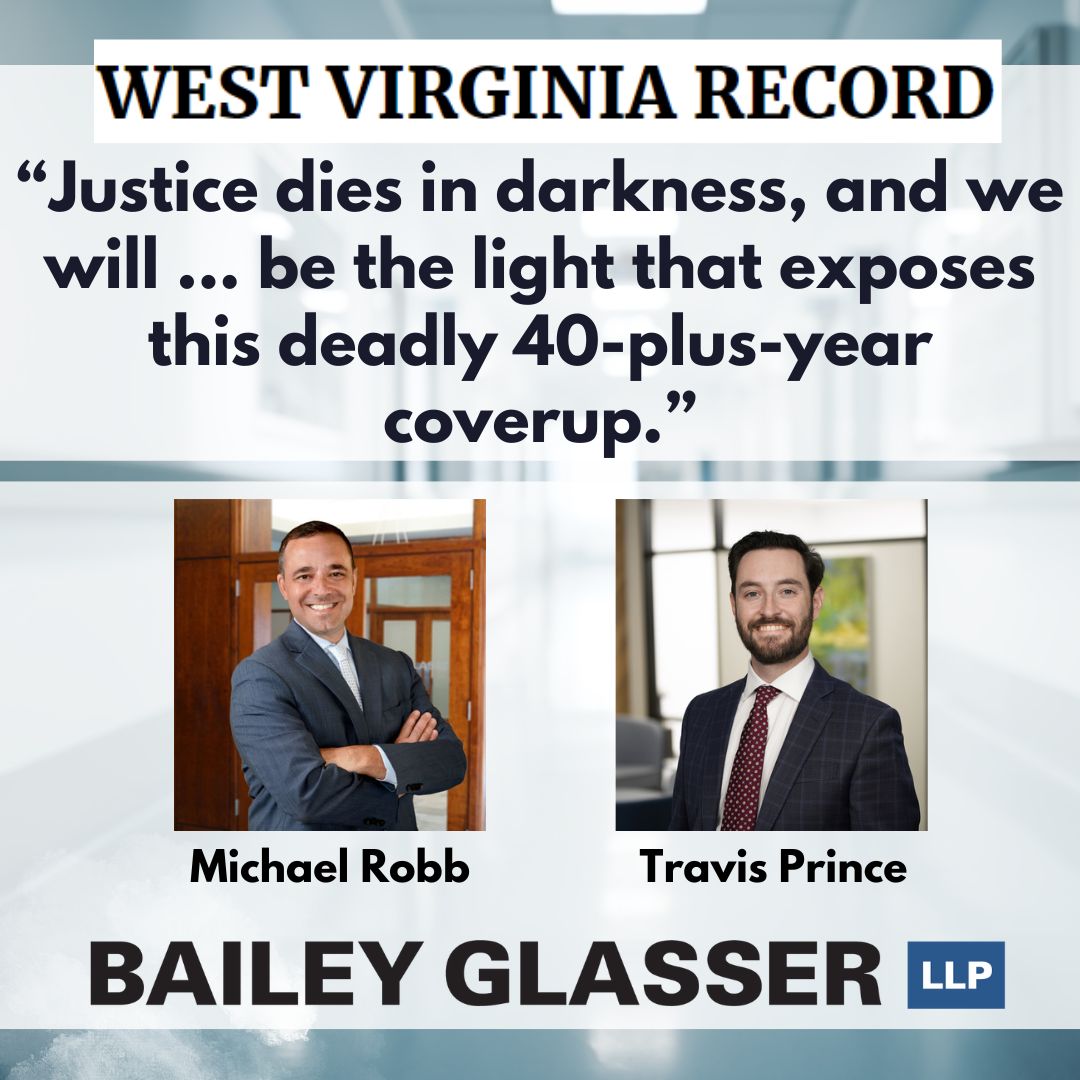

A lawsuit brought by Bailey Glasser Asbestos & Lung Disease partners Michael Robb and Travis Prince on behalf of Donna Spurling, a former Fairmont State University (FSU) nursing student who developed terminal lung cancer from asbestos exposure, continues to draw significant media coverage.

The latest coverage comes from the Times West Virginian, highlighting the legal fight for transparency and accountability from both FSU and the West Virginia Board of Risk Insurance Management (BRIM).

The article details how FSU and BRIM are using sovereign immunity defenses to avoid liability and block discovery into their insurance policies that could cover the Plaintiff’s claims and would pierce the sovereign immunity defense. The lawsuit alleges Ms. Spurling contracted terminal lung cancer after being exposed to asbestos while a nursing student at Fairmont State University in the late 90s. Spurling argues that Fairmont State’s failure to cover her for asbestos exposure violates her constitutional rights and that the defendants have engaged in bad-faith settlement negotiations, denying discovery that would reveal the extent of insurance coverage provided by the state.

In the article, Travis Prince strongly criticizes the Defendants’ tactics, stating: “BRIM, in concert with FSU’s Board of Governors, has engaged in a game of charades to prevent Ms. Spurling from understanding the true extent of insurance coverage provided by the state.” Prince also calls for greater transparency, arguing that discovery is essential to uncover whether additional insurance exists to cover Spurling’s claims.

Read the full article here.

To learn more about Michael Robb, visit here.

To learn more about Travis Prince, visit here.