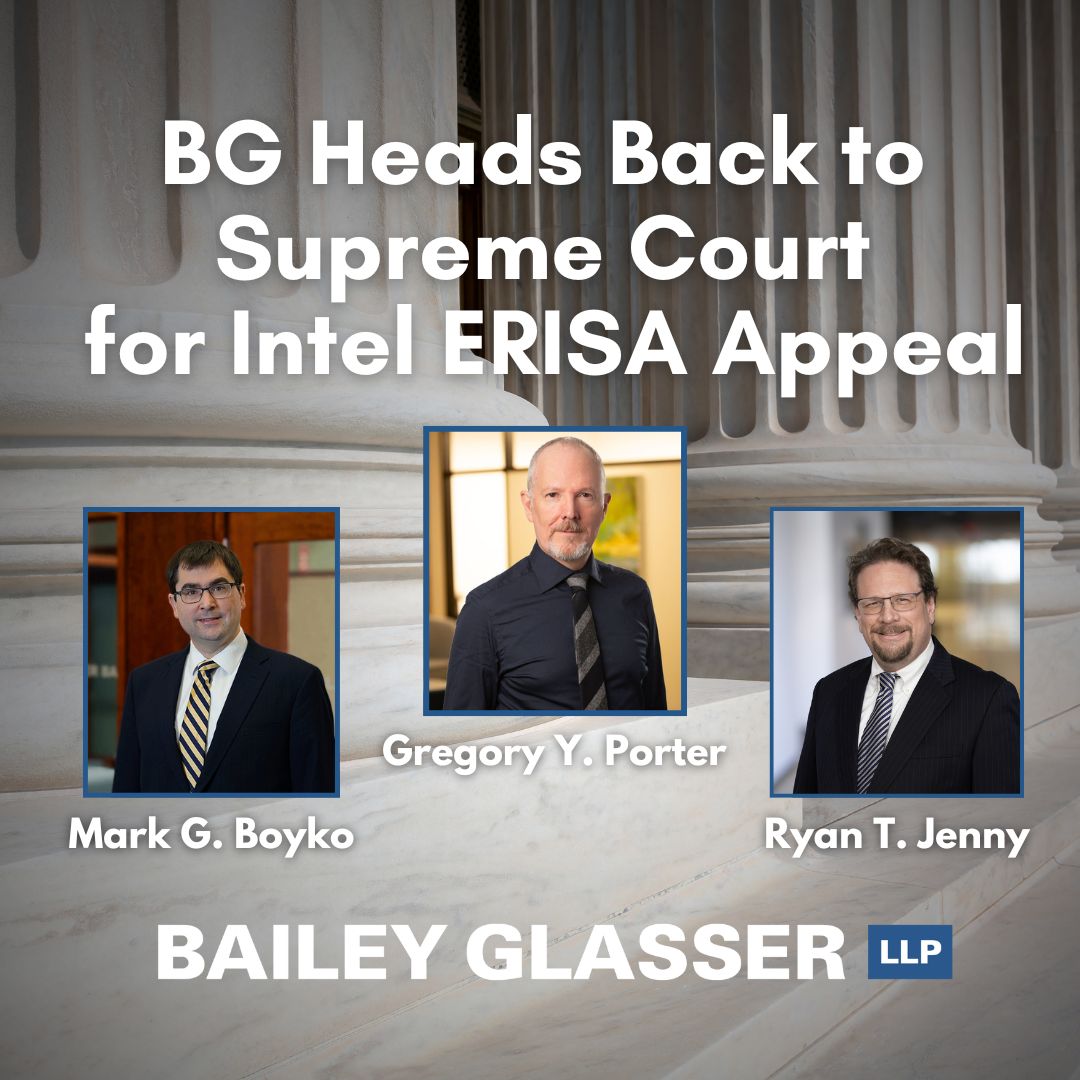

Bailey Glasser Heads Back to Supreme Court for Intel ERISA Appeal

The Supreme Court of the United States granted the petition for certiorari filed by Bailey & Glasser, LLP and co-counsel on behalf of clients Winston Anderson and Christopher Sulyma in their ongoing case against the Intel Corporation and the Intel fiduciaries responsible for investing Intel’s retirement plans. The plaintiffs allege that the defendants mismanaged retirement plan assets by stuffing target date funds in the Intel plans with expensive, opaque, and esoteric private equity and hedge fund investments. These outlier investments caused Intel employees to lose hundreds of millions of dollars in retirement savings.

Gregory Porter, BG’s ERISA Practice Group Leader and leading co-counsel in this case, said, “This case presents a critical opportunity to clarify how courts evaluate fiduciary decision-making in complex retirement-plan investments, particularly as plans increasingly incorporate alternative and nontraditional assets.”

In addition to Greg Porter, the petition was filed by Bailey Glasser’s nationally recognized ERISA litigation team, which includes partners Mark Boyko and Ryan Jenny, as well as co-counsel from Gupta Wessler LLP and The Barton Firm LLP.

Plaintiffs, long-time Intel employees and participants in the company’s retirement plans, allege that Intel’s plan fiduciaries violated their duties of prudence and loyalty under the Employee Retirement Income Security Act of 1974 (ERISA). The complaint contends that the fiduciaries invested billions of dollars of plan assets in unproven, high-risk, and illiquid alternative investments, such as hedge funds and private equity, through custom target-date and multi-asset funds, exposing participants to unnecessary risk and underperformance relative to traditional retirement investment options.

The U.S. District Court for the Northern District of California dismissed the case, holding that the complaint did not plausibly allege imprudence or disloyalty because it failed to identify “meaningful benchmarks” for comparing the Intel funds’ performance. In May 2025, the U.S. Court of Appeals for the Ninth Circuit affirmed, concluding that ERISA plaintiffs must identify comparator funds with similar objectives, risks, and rewards to support claims of imprudent investment even when no such benchmark exists because no similarly-situated fiduciaries embarked on such reckless conduct.